send link to app

UK Dual Salary Calculator app for iPhone and iPad

4.6 (

6336 ratings )

Reference

Finance

Developer: Richard Hope

0.99 USD

Current version: 1.1, last update: 5 years agoFirst release : 14 Aug 2017

App size: 14.54 Mb

FEATURES:

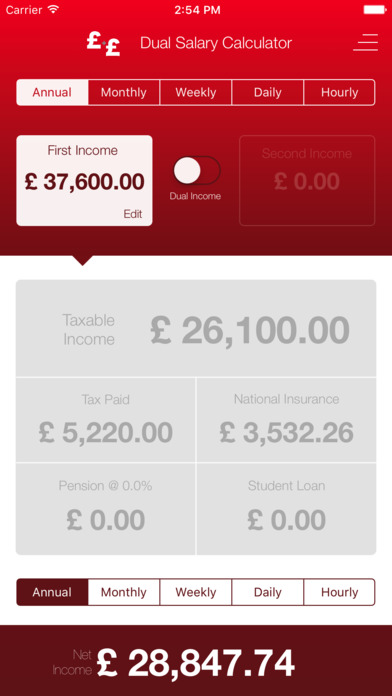

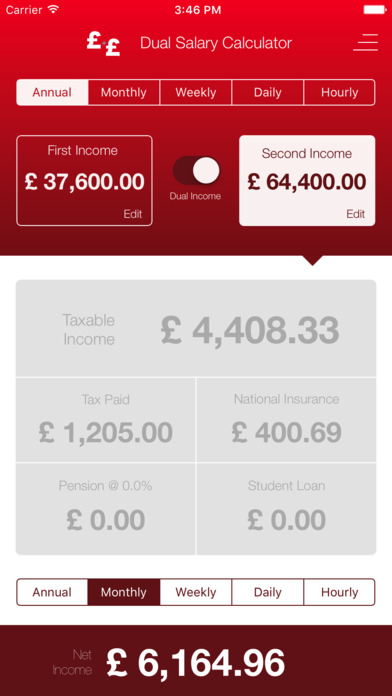

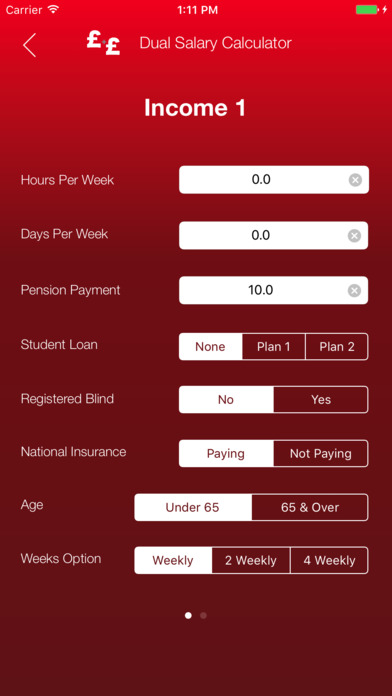

Yearly, monthly, 4-weekly, weekly, daily and hourly breakdown of income tax (20%, 40% and 45%), National Insurance contributions, pension contributions, student loans for either a sole income or an additional income.

It calculates your default tax allowances based on your age and income. Find out what your income and an additional incomes take home (or net) income would be.